The Facts About The Best Scalping Technique Uncovered

Table of ContentsThe Main Principles Of The Best Scalping Technique Getting My The Best Scalping Technique To WorkIndicators on The Best Scalping Technique You Need To KnowThe Main Principles Of The Best Scalping Technique The Best Scalping Technique Things To Know Before You Buy

Scalpers look for to benefit from little market motions, benefiting from a ticker tape that never stalls. For several years, this fast-fingered day-trading group depended on Level 2 bid/ask displays to locate deal signals, reading supply and need discrepancies away from the National Ideal Proposal as well as Deal (NBBO)the bid/ask cost that the typical person sees. Scalpers can meet the challenge of this age with three technical signs custom-tuned for temporary possibilities. The signals utilized by these real-time devices are comparable to those utilized for longer-term market techniques, but rather, they are applied to two-minute charts. They function best when highly trending or strongly range-bound action regulates the intraday tape; they don't work so well throughout periods of conflict or complication.An instant leave is needed when the indication crosses and rolls versus your placement after a rewarding drive. You can time that exit much more specifically by watching band interaction with cost.

Additionally, take a timely leave if a rate drive fails to reach the band however Stochastics surrender, which informs you to obtain out. As soon as you fit with the process and also communication in between technological elements, feel complimentary to change standard variance higher to 4SD or lower to 2SD to make up day-to-day adjustments in volatility.

Pull up a 15-minute chart with no signs to keep track of background conditions that might influence your intraday performance. Include 3 lines: one for the opening print as well as 2 for the low and high of the trading variety that established in the very first 45 to 90 minutes of the session. The Best Scalping Technique.

The Greatest Guide To The Best Scalping Technique

Scalpers can no much longer depend on real-time market depth analysis to get the buy and also sell signals they require to publication several small revenues in a common trading day.

Lots of investors earn decent revenues touching into this volatility. One typical means to go about trading is recognized as scalping a busy trading strategy that includes making a large number of trades, each resulting in small revenues.

And also they're a lot cooler than Jeff Bezos. As soon as little rate activities press the property to the scalp investor's earnings objective, the investor markets the placement as well as steps on to the following.

The Basic Principles Of The Best Scalping Technique

Only supplies with high trading volume are considered for this approach. Price activity is essential to any effective trade, and also the scalp-trader wants points to happen swiftly., meaning they are known for fast-paced price fluctuations.

When searching for a strong entry, the investor uses real-time graphes with a brief time frame, using tick or one-minute charts to analyze price moves. When scalpers see chances, they get in the trades, maintaining their mouses on the "sell" button, prepared to pay out at the initial sign of revenue.

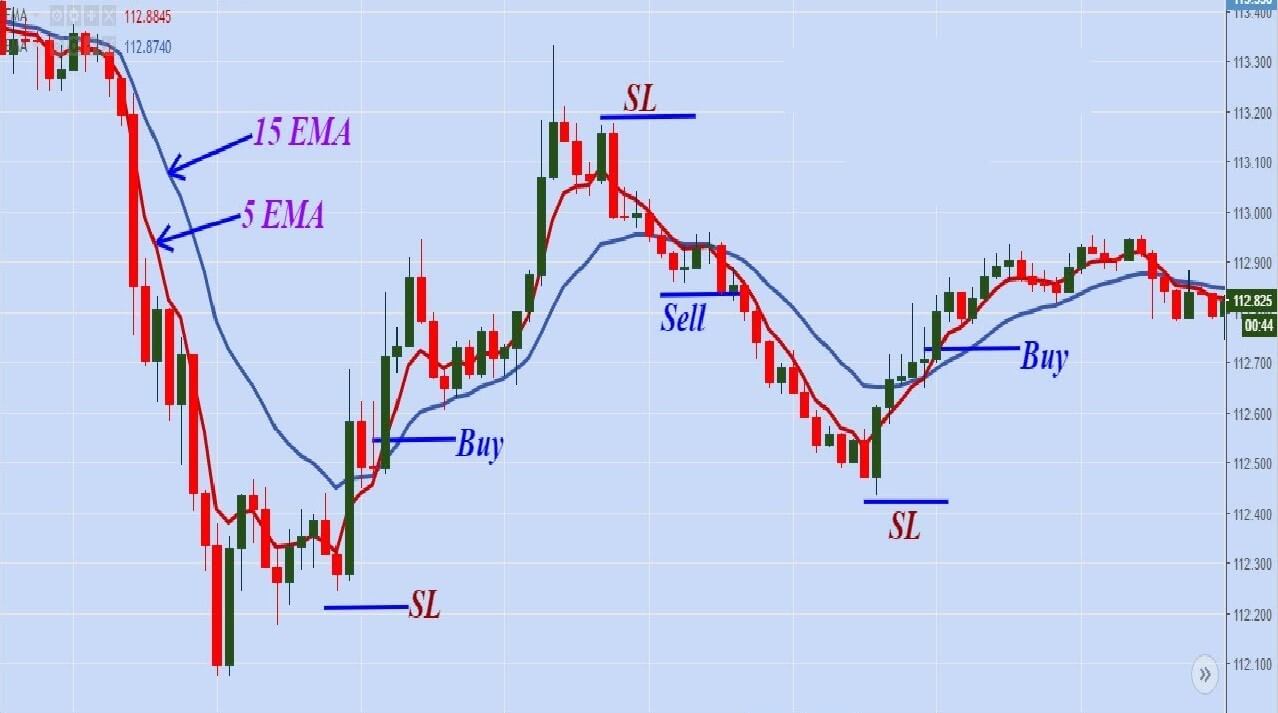

Traders usually utilize several moving standards readied to different time structures as well as look for crossovers. When a short-term SMA crosses over a long-lasting SMA, it recommends that the stock is likely to move up (The Best Scalping Technique). Conversely, when the short-term SMA crosses below the lasting SMA, it suggests the stock is likely to move downward.

The 45-Second Trick For The Best Scalping Technique

On a MACD chart, the boundaries are established at extreme highs as well as extreme lows, and also MACD and also signal lines in the center oscillate between both. Investors seek crossovers as an indication of altering momentum. When the MACD line crosses navigate to this site over the signal line, the signal is favorable. A MACD line that goes across below the signal line suggests decreases could be in advance.

Traders use the stochastic oscillator to obtain signals directly prior to motions happen in the market. The scalp trading method is interesting but high-risk.

It is very important not to obtain hoggish as well as keep a winning trade long enough for it to reverse as well as come to be a loss. Check your emotions at the door before you start trading. Constantly prepare to act. Modifications happen swiftly out there, so you can't take your eyes off the sphere.

It's hectic, it might bring about tremendous earnings, and it's a fairly basic technique to release. It's not for everyone. As with any type of other temporary trading approach, scalp trading comes with a high degree of threat. It's best for an extremely risk-tolerant capitalist who has lots of time to recover ought to something fail.

9 Simple Techniques For The Best Scalping Technique

As with any kind of other trading strategy, the scalping approach comes with its very own checklist of pros and disadvantages that must be Read More Here attentively thought about before diving in. There are a number of benefits to scalping in the supply market - The Best Scalping Technique.

If you have the technical evaluation skills and also an eager understanding of how the market works, you might become the next significant success. As a hectic strategy, scalping requires traders to constantly seek the next chance and also watch on open professions. Numerous investors locate it an interesting method to maintain themselves active while making money in the market.

Although there are lots of reasons to be excited regarding starting with this trading this contact form method, there are additionally a couple of considerable disadvantages to scalping. Traders bank on small cost adjustments and small profits. That suggests one bad mistake that results in a huge loss could be sufficient to wipe out your entire trading day's profits or even more!.